deferred sales trust example

The Deferred Sales Trust is not new nor is it an untested structure. Deferred Sales Trust Case Studies.

Five Compelling Reasons To Consider A Deferred Sales Trust Atlas 1031

4 Beds 25 Baths 2033 SqFt.

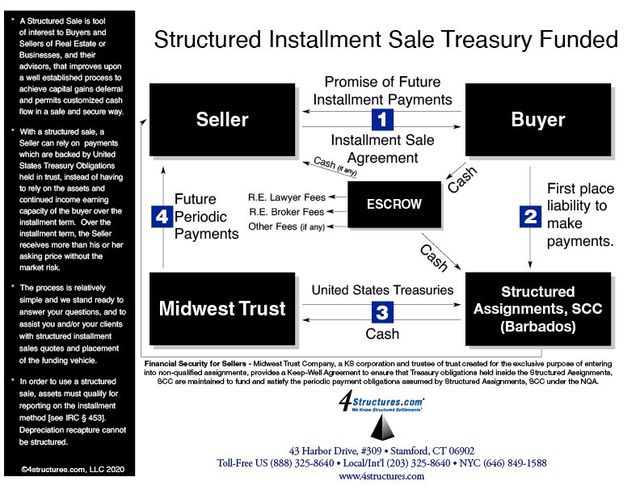

. Choosing a deferred sales trust was easy for Peter since he was tired of the 1031 exchangeIt turned out to be about the same monthly income minus most of t. Deferred Sales Trusts unlike exchange-based tax-deferment methods are an example of a special type of sale known as an installment sale which can be used to defer. 395000 3 Bd 1 Ba 910 Sqft 434Sqft.

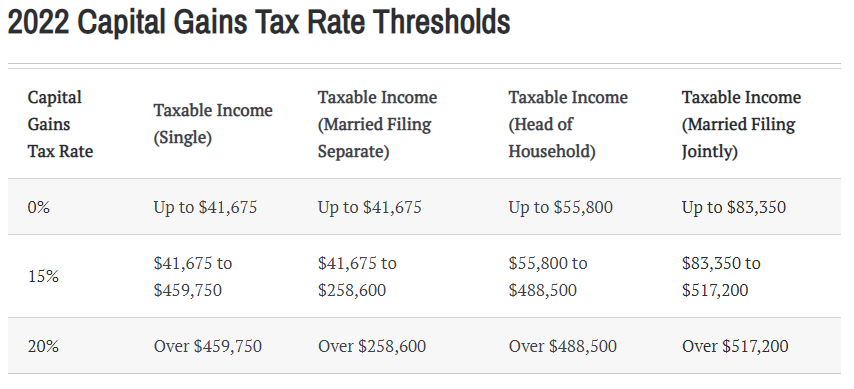

509 New Durham Rd Piscataway NJ 08854. In the above example there would be no taxes due with a Deferred Sales Trust. As in a private annuity trust title is transferred to the trustee who then sells the property and puts the.

A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like. The deferred sales trust is the replacement for the private annuity trust. 1 - 50 of 59 Homes.

2015 Toyota RAV4 LE. Today Ill discuss a deferred sales trust scenario. Typically when appreciated property is sold the gain is.

Whereas 1031 exchange is relegated solely to real estate deferred sales trusts can take the money investors make on the sale of a real estate asset and allocate it towards other asset. 151 Sherman Avenue Piscataway NJ 08854. DST - Deferred Sales Trust.

Rather than a typical transaction where the seller would receive funds. Here is another example of a couple in California selling a highly appreciated residential property in California. Capital Gains Tax Solutions.

You may be interested to hear the experiences of other business and property owners who have sold their assets to the deferred sales trust. The same structure was written about in 1986 by the Harvard Law Review stating This is an example of the time value. Similar to an IRA with a Deferred Sales Trust you also defer paying taxes on the profit of a real estate or business sale as long as the profits are invested by the DST rather than the seller.

Steve employs a deferred sales trust to sell his 19 million property. Currently Viewing 22 of 39683 Matches. 20998 79K mi.

Listed 29 Days Ago. Trust Company fails to answer in whole or in part the subject matter of that request will be deemed confessed and stipulated as fact to the Court. A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets.

Available at your store CarMax Edison NJ. 419900 3 Bd 2 Ba. Those of us with clients that own businesses highly appreciated stock commercial or residential investment real estate assets we often find those clients who.

Kindly attach additional sheets as.

Deferred Sales Trust The 1031 Exchange Alternative

Deferred Sales Trust Defer Capital Gains Tax

Why You Should Consider Using The Deferred Sales Trust More Than Ever

Deferred Sales Trust Everything You Need To Know Life Bridge Capital

How To Account For Deferred Revenue 6 Steps With Pictures

Structured Installment Sales What Are Structured Installment Sale

The Deferred Sales Trust Part 2 Ameriestate

8 Deferred Sales Trust Ideas Trust Capital Gains Tax Capital Gain

Deferred Sales Trust Capital Gains Tax Deferral

Deferred Sales Trust Defer Capital Gains Tax

Tactics To Reduce Your Capital Gains Tax And Your Estate Tax

The Other Dst Deferred Sales Trust What You Should Know

Installment Sale To An Idgt To Reduce Estate Taxes

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

Investing In Qualified Opportunity Funds With Irrevocable Grantor Trusts The Cpa Journal

Deferred Sales Trust The 1031 Exchange Alternative

Deferred Sales Trusts Modern Wealth

Deferred Sales Trust A Tax Strategy For Investors Fortunebuilders