salvation army car donation tax deduction

According to the IRS Guidelines you may claim fair market value for your donation up to the actual sale value. Salvation Army Car Donation How to Donate.

Car donations are tax-deductible.

. Your vehicle donation will be used to help. If your vehicle is. Ad Call or Donate Your Car Online.

Ad Call or Donate Your Car Online. In Notice 2005-44 the IRS and Treasury explain rules adopted in the American Jobs Creation Act of 2004 which 1 generally limits the deduction to the actual sales prices of. The person who donates their car receives the tax deduction.

Its as easy as filling out the. A vehicle donation can bring you between 500 and up to 5000 in tax credit whether your car donation goes to goodwill car donation salvation army car donation purple heart car. Your vehicle will be picked up for free and you will get a tax deduction.

Donate your unwanted vehicle. Someone who donates a car receives a deduction in taxation and. Salvation Army car Auction helps others also makes their life different with the support of Donation.

If you are outside of Florida and have questions about donating to. Transforming Lives Since 1996. We can provide quick and convenient vehicle pick-up and towing just about anywhere in all 50 of the United States.

According to the IRS the following limits only apply to taxpayers who have made charitable donations amounting to more than 20 percent of their adjusted gross income AGI. Donate Your Vehicle Enter your ZIP code to find vehicle donation services in your area. The Original Nationally Acclaimed 1 Veterans Car Charity.

And the Salvation Army doesnt charge donors for repairs. Its Easy Call Us or Use Our Online Donation Form. Only this classification of charity is eligible to offer official tax deductions for vehicle donations.

Find out how much the charity sold the car for. Donate today quickly and easily. For more detailed information on how to donate your vehicle give us a call at 1-800-SA-TRUCK 1-800-728-7825 or start a vehicle donation.

Your vehicle will be picked up for free and you will get a tax deduction if you itemize. The Original Nationally Acclaimed 1 Veterans Car Charity. Enter your ZIP code to find vehicle donation services in your area.

The higher your income bracket the more likely your donations to the Salvation Army or Goodwill will reduce your tax bill. There is some process to follow. A percentage of each donation is deducted from what you owe.

Its Easy Call Us or Use Our Online Donation Form. Here are 4 simple steps and tips to help you understand and claim a tax deduction for your donated car on your tax return. Ad Best Worst Car Charities Revealed HereFair Market Value Tax Deduction is Still Possible.

So donating a car is a great way to give back to the community and get tax benefits. Salvation Army car donation helps people in need and makes their lives more enjoyable by assisting them with donations. If your vehicle is sold for more than 500 the maximum amount of your.

Find our what percentage of the FMV fair market value you will be able to claim on taxes. How much can you donate to the salvation army or goodwill. After the costs of towing and conditioning the car and processing the paperwork is deducted little may be left for charity.

Only this classification of charity is eligible to offer official tax deductions for vehicle donations. All of the clothing furniture. Whatever the amount they got for the car or truck you can claim a tax deduction up to 5000.

At an auto auction the charity could get as little as 50 for the vehicle but if you know the worth. Currently you can only itemize deductions such as for donating a vehicle on Schedule A of. Transforming Lives Since 1996.

The Salvation Army restores families that have been disrupted due to homelessness and substance abuse. Donate today quickly and easily. You just want to donate your car to the salvation army and the Salvation Army will use this car the helping people who have a dire condition.

MAKING A CAR DONATION IS EASY. Find our what percentage of the FMV fair market value you will be able to claim on taxes. Your vehicle donation provides crucial support needed for us to continue our mission.

Additionally some charities may receive a flat fee for. Donating your vehicle is a hassle-free process. Learn about the locations of the charity car donation program in RIVERSIDE County CA including Salvation Army - Donation Trailer.

The Salvation Army has also published a legal memorandum on tax exemptions. Ad Best Worst Car Charities Revealed HereFair Market Value Tax Deduction is Still Possible. View their street address and business hours below.

You can either go online to your states Salvation Army site and complete the. Donating a car to the Salvation Army shows your support of this wonderful organization while generating a highly desirable tax deductionA Salvation Army car donation enables you to.

Lehigh Valley Pa Car Donations

How To Get A Donated Car From Salvation Army Free Cars Help

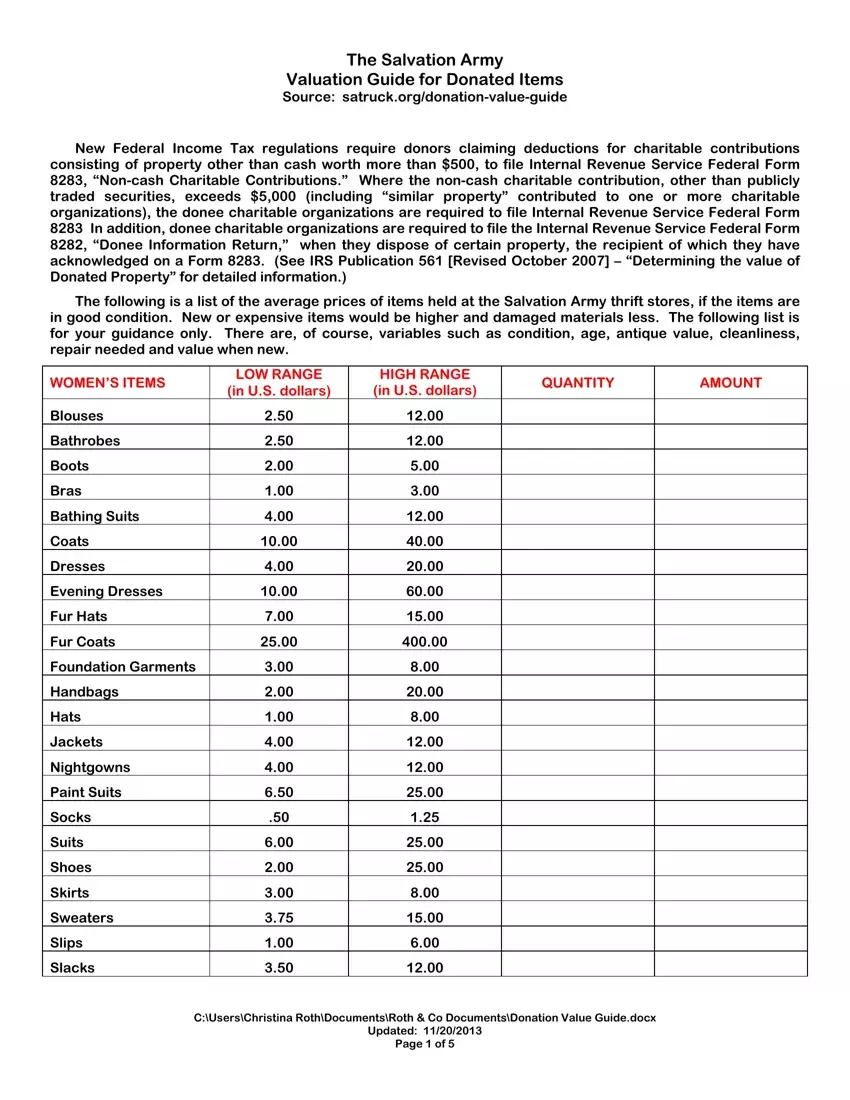

Salvation Army Goodwill Tax Deduction Donation Guidelines

How To Get A Donated Car From Salvation Army Halo Home

Salvation Army Tax Receipt Fill Out Printable Pdf Forms Online

Salvation Army Thrift Store Donation Value Guide Turbo Tax

How To Get A Donated Car From Salvation Army

Free Salvation Army Donation Receipt Word Pdf Eforms

Free Salvation Army Donation Receipt Template Cocosign

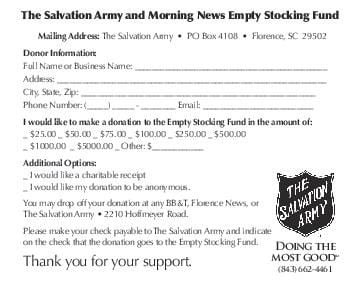

Salvation Army Donation Form Scnow Com

The Salvation Army Car Donation Benefits Process

Can You Deduct Donations To The Salvation Army Pocketsense

The Salvation Army Family Store Hyattsville Md Home Facebook

Free Salvation Army Donation Receipt Word Pdf Eforms

Salvation Army Goodwill Tax Deduction Donation Guidelines